前天(4/26/2017),財政部長Steven Mnuchin和白宮國家經濟委員會主席Gary Cohn在白宮新聞發佈會給大家透露了很多稅法改革的重磅消息,聲稱這次稅改將是自1986年稅改最顯著的一次並且也是美國歷史上最大的減稅改革。川普的大刀果真向稅頭上砍去了!

其實早在16年9月競選的時候,川普就已經公布了他的稅改方案,當時the Tax Foundation的一個報告估算這個方案會減少聯邦政府收入$4.4 trillion 到 $5.9 trillion,在考慮經濟增長等因素會縮小為 $2.6 trillion 到 $3.9 trillion。而此次,大部分方案都保持或者做了小幅修改,還有很多尚在計算考量中。儘管川普政府一直強調隨着經濟增長,減少不必要的減免和杜絕漏洞,稅改會pay for itself,國會是否相信並通過,我們拭目以待。

接下來簡單分析一下稅改對大家的影響。因為目前白宮並未公布官方文件,本文將依據白宮官網簡報。開始之前我們簡單回顧一下個人報稅的公式,方便大家理解:

Total Income 總收入如W2,1099,股票等等

– Adjustment 調整項如退休賬戶和學費

= Adjusted Gross Income (AGI)

– Large of Itemized deductions or standard deduction (每個人$6,300) 兩者選大的抵扣

– Exemptions 每個人額外$4,050免稅額

=Taxable Income 應納稅所得

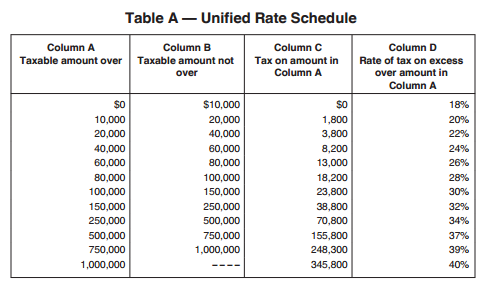

>>> Tax 根據累進稅率表算稅

– Alternative minimum tax 見後文

– Tax credits 例如教育,撫養子女

= Total tax 一年納稅總額

– total payments 預繳

= Amount you owe or overpaid 多退少補

註:其中Itemized deductions最常見的內容包括當年所有預繳的州稅和地方稅,房產地稅,房貸利息,慈善捐款。

個稅七傷拳:

第一招:「We are going to cut taxes and simplify the tax code by taking the current seven tax brackets we have today and reducing them to only three brackets — a 10 percent bracket, a 25 percent bracket, and a 35 percent bracket.」

和中國類似,美國目前的個稅稅率有七檔是10%,15%,25%,28%,33%,35%,39.6%,現在要改為10%,25%,35%三檔。總體來說稅率是降低了,但是具體bracket並沒有說,所以對不同收入的影響不盡相同。比如說2016年夫妻合報taxable income在$75,300以內只有10%和15%的稅率,但如果新的bracket是$70,000開始25%,那麼相當於多出的5000多就要按照25%交稅,那麼新稅法就反而增稅了。

第二招:「We’re going to double the standard deduction so that a married couple won’t pay any taxes on the first $24,000 of income they earn. So, in essence, we are creating a zero tax rate — yes, a zero tax rate — for the first $24,000 that a couple earns.」

第三招:「The largest standard deduction also leads to simplification because far fewer taxpayers will need to itemize, which means their tax form can go back — yes — to that one simple page that I talked about earlier…. We’re going to eliminate most of the tax breaks that are mainly benefits to high-income individuals. Homeownership, charitable giving and retirement savings will be protected. But other tax benefits will be eliminated.」

第二招和第三招要結合在一起看,一個是雙倍標準扣除額,一個是簡化列舉扣除額。兩者報稅的時候只能選其一來抵扣收入,所以目前來看更多人將會直接用標準扣除額,因為更大而且列舉扣除額可減項大幅縮減。根據後面的記者提問,財政部長明確表示只有房貸利息和慈善捐款這兩個抵稅會保留,甚至不包括州稅(這點導致高州稅州處於不利地位)。那麼對於很多家庭如果貸款不算太多又沒有捐款,是很難超過$24,000這個界限的。而且這裏面有個很狡猾的地方,根據去年的提案,personal exemption也是要拿走的,那麼實際上也就是從原本的夫妻可抵稅約兩萬(12,000 standard deduction加上8,000 personal exemption)變到了兩萬四而已。當然發佈會的時候並沒有提personal exemption,如果真是這樣,那川普就真的不夠意思了。

第四招:「Families in this country will also benefit from tax relief to help them with child and dependent care expenses.」

撫養子女會享受到稅收優惠。沒有太具體的內容,不知道是在現有的credit基礎上加強還是增加新的抵扣措施。

第五招:「We are going to repeal the alternative minimum tax. The AMT creates significant complications and burdens which require taxpayers to do their taxes twice to see which is higher. That makes no sense, and we should have one simple tax code.」

去掉AMT。什麼是AMT,簡單地說就是稅局怕你稅沒有交夠,所以讓你換種方法再算一算,不夠就再補點。一般高收入群體或者有incentive stock option等會遇到這種情況,去掉這個,倒的確是簡化了些。

第六招:「As we all know, job creation and economic growth is the top priority of the administration. Nothing drives economic growth like capital investment. Therefore, we are going to return the top capital gains tax rate and dividend rate to 20 percent, repealing the harmful 3.8 percent Obamacare tax on dividends and capital gains. That tax has been a direct hit on investment income and small business owners. 」

廢除奧巴馬政府的額外3.8%股息和資本利得稅,鼓勵投資。這裏面提到最高20%的稅率,應該還是限制在qualified dividend和long-term capital gain。比如短期的股票賺錢,還是要按正常收入稅率交稅的,根據目前信息不會cap到20%。

第七招:We’re going to repeal the death tax. The threat of being hit by the death tax leaves small business owners and farmers in this country to waste countless hours and resources on complicated estate planning to make sure their children aren’t hit with a huge tax when they die. No one wants to see their children have to sell the family business to pay an unfair tax.

最有意思的一個部分,廢除death tax,也就是estate tax。美國的遺產稅很高,最高稅率達到了40%,但是只要在總遺產加生前送出的禮物總額超過$5,490,000(2017)才會開始計算。所以這最後一招必殺,是為富人們準備的。總統是否會因為這點受益,也成為新聞發佈會的焦點之一。

公司稅不明朗:

Under the Trump plan, we will have a massive tax cut for businesses and massive tax reform and simplification. As the President said during the campaign, we will lower the business rate to 15 percent. We will make it a territorial system. We will have a one-time tax on overseas profits, which will bring back trillions of dollars that are offshore to be invested here in the United States to purchase capital and to create jobs.

公司稅簡單帶過,稅率降到15%,從全球徵稅體系改成領土製,僅一次優惠離岸資金徵稅從而可以資本自由流入。可以說是很大膽的舉措,但是還有很多疑問(比如flow through entity本來就不用交聯邦稅而是在個人名下交稅,這種情況有何變化)和操作難點,值得關注。

這次稅改,川普七傷拳到底會傷到財政還是勞苦大眾,還難下定論,不過似乎對於富人們來說,怎麼都是一個重大利好。

本文僅分析稅改,並無任何政治觀點。

Reference:

https://files.taxfoundation.org/20170210092631/TaxFoundation_FF528_FINAL3.pdf