Our new home

Contents

Introduction

People involved with credit-card churning often wonder what the impact of lots of credit inquiries and new accounts will be on their ability to qualify for a loan at a reasonable interest rate. I just went through this process and was approved for both a new mortgage and used car loan. Below I share my experience and some recommendations that may be helpful in your new home or vehicle pursuit.

If you haven’t seen my previous posts in this series, please check out 66 Credit Card Approvals in 3 Years and Signup Bonus Math: The Best Return on Credit Card Spend. These posts provide background information for the story I present below.

Disclaimer

This post is not a guide, but rather my story. I am not suggesting or advocating for anyone to follow my lead; rather, I am simply showing what has worked for me. Individual lenders will have a unique definition of risk and act according to their own risk tolerance. A lot goes in to an individual’s ability to secure a loan beyond what is shown on their credit profile, such as income and other liquid assets. YMMV.

The Mortgage Process

While I have had car loans in the past, this was my first experience dealing with a mortgage. For those who have never bought a house, the process works like this. As the buyer, you hire a real-estate professional who is qualified to help you shop for and tour homes. Once you find a home, they effectively act as a middleman on your behalf to get the best deal possible from the seller.

During (or prior to) the home-shopping process, you need to find a Loan Officer with a bank or mortgage company. The Loan Officer processes all of your personal information, runs a credit check, and gives you an idea of what your interest rate will be based on different combinations of loan amount, loan type and duration, and the amount of your down payment. Be sure to shop around with different banks/loan officers to be sure you are getting a fair interest rate. Once the Loan Officer runs all your information, they send the application to an Underwriter who either approves, conditionally approves, or denies the loan application.

Transparency with the Loan Officer

The Loan Officer should be your best friend during this process. They will be the one reviewing your credit and acting on your behalf once the loan is sent to an underwriter. Do not hide anything from the Loan Officer! Any surprises that come up later in the process will only cause delays, which in a competitive market may influence your ability to get the house you want.

During my first conversation with our Loan Officer, we discussed everything from income to natural disaster preparedness. Once it got to the point where he asked about running our credit, I was 100% transparent.

“You are going to see a lot of recent inquiries and new revolving credit accounts on my credit report, and a low average age of accounts. But as you will see on my credit report, I have never paid interest or carried any credit debt,” I told him.

He responded with “That’s good to hear, though we only really care what is shown for the previous four months.”

Normally that would be fine… but I had 17 inquiries over the previous four months on my credit report, 16 of which were from credit card applications, INCLUDING BUSINESS CARD APPLICATIONS. While business cards can help you skirt the Chase 5/24 rule, they will appear on your credit profile if you are applying for a mortgage.

Recommendation #1 – Cool It With New Credit Inquiries for 4+ Months

The general rule of thumb is no new applications or activity on your credit report in the months leading up to securing a loan. The Loan Officer’s comment posted in bold above confirms why – when attempting to secure a multi-hundred-thousand-dollar loan, you need to appear financially stable.

I had no idea we would be purchasing a house four-months prior to submitting an offer for one. At that time, I didn’t even know we would be moving from Seattle to a place where we could immediately afford a house. I hardly even knew one month prior, and had no way to prepare my credit report for such an event. Everything worked out for me in the end and I was able to explain everything away, from new credit inquiries to manufactured spending (more below), but your success in doing this likely depends on 1) how good your story is, 2) how bulletproof your credit report is otherwise, and 3) how easily your Loan Officer becomes spooked.

When the Loan Officer asked about the 16 recent inquiries, I told him briefly about this hobby and that I need to have experience with the bank products I review in order to write about them on this blog.

He replied with “That sounds reasonable, but I hope you keep good records because we will need to explain this to the underwriter.”

Luckily, I keep detailed records of everything.

Recommendation #2 – Keep Records of Everything

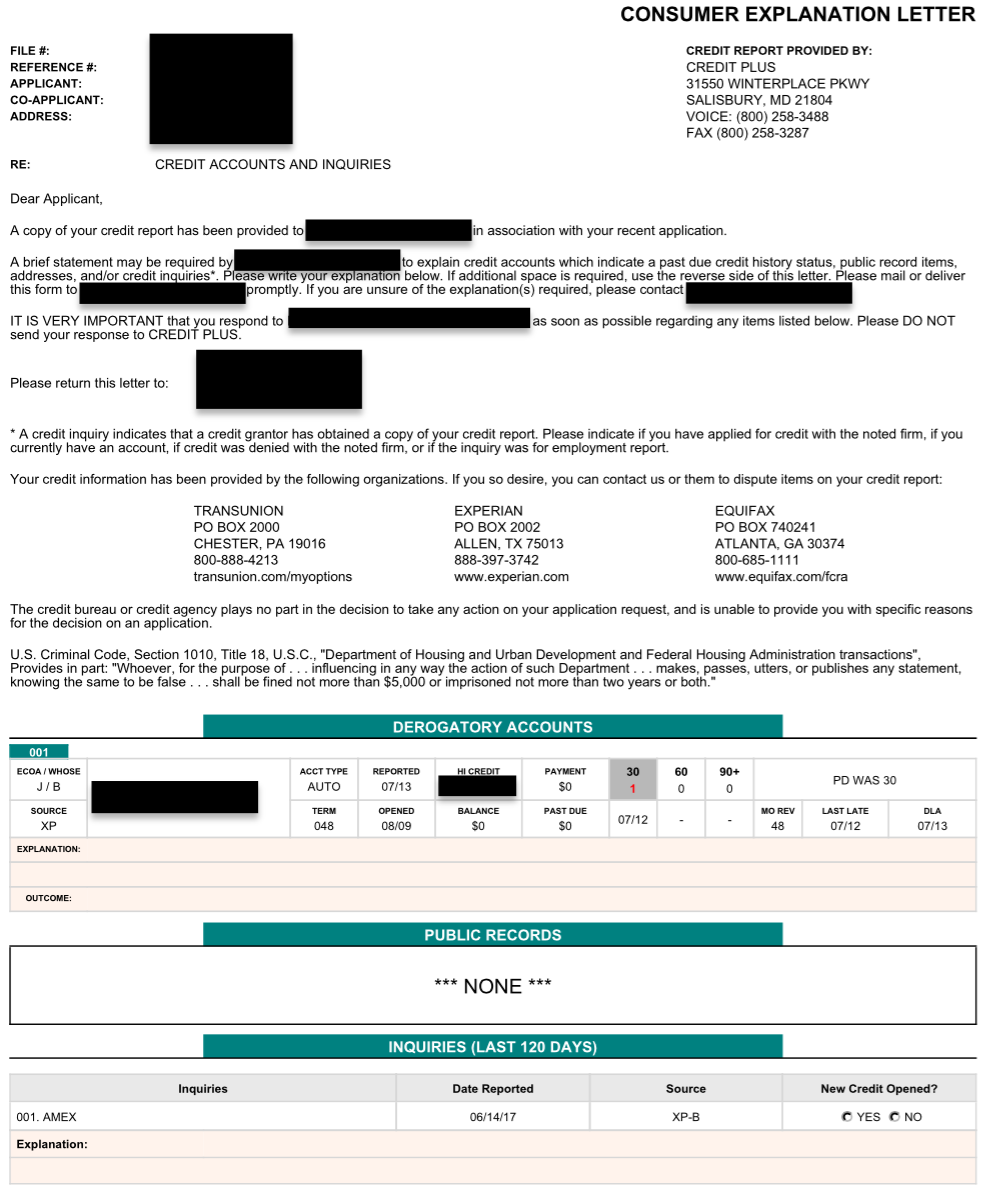

Shown below is a copy of the (redacted) Consumer Explanation Letter (CEL) I had to complete to explain the information shown on my credit report. Along with this, the lender wanted the two most recent credit-card statements associated with each of the inquiries to see that I wasn’t running up tons of debt in the months leading up to securing a mortgage loan.

You will see on the CEL that multiple banks appear multiple times, on different dates. For example, Amex appears on that list five times. If I didn’t meticulously track all details associated with this hobby, it would have been much harder to figure out which account matched with which inquiry. The Loan Officer and Underwriter corroborate the information on the CEL with each credit-card statement by matching your available credit lines, which they can see from your credit report. Therefore, you MUST know which account corresponds to which inquiry.

Because I had this information, and to assist the Loan Officer and Underwriter, I included the last 4 or 5-digits of each account and account name in the “Explanation” section of the CEL so they could easily track which statement belonged to which inquiry. For the actual Explanation, I simply wrote “Related to blog reviewing credit cards” for each inquiry. I also considered writing something like “Related to earning miles and points for travel.” Your Loan Officer should guide you through this.

Note there is also one 30-day derogatory payment for a car loan I forgot to pay while I was traveling during graduate school over five years ago, which I had actually forgotten about. Wells Fargo also appears three times, though I only submitted two applications to them during this period. Perhaps they reran my credit when I called reconsideration?

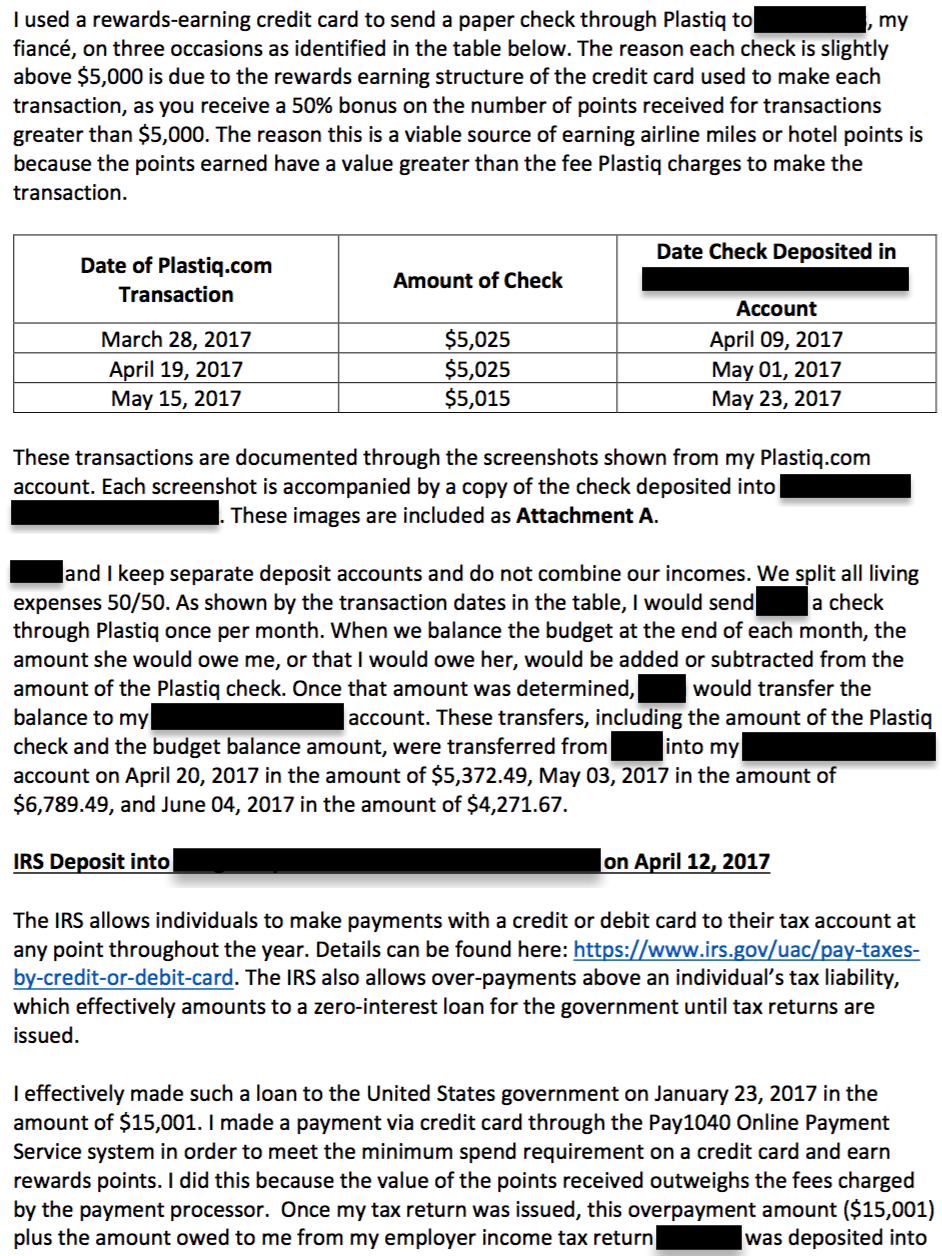

Recommendation #3 – Have an Explanation for ALL Large Bank Account Deposits

In addition to the CEL and associated credit-card statements, my fiancé and I each had to submit employer pay stubs and three months worth of primary bank-account statements. After reviewing the statements, the Loan Officer came back and requested documentation for each large deposit that was greater than 50% of the average employer deposit.

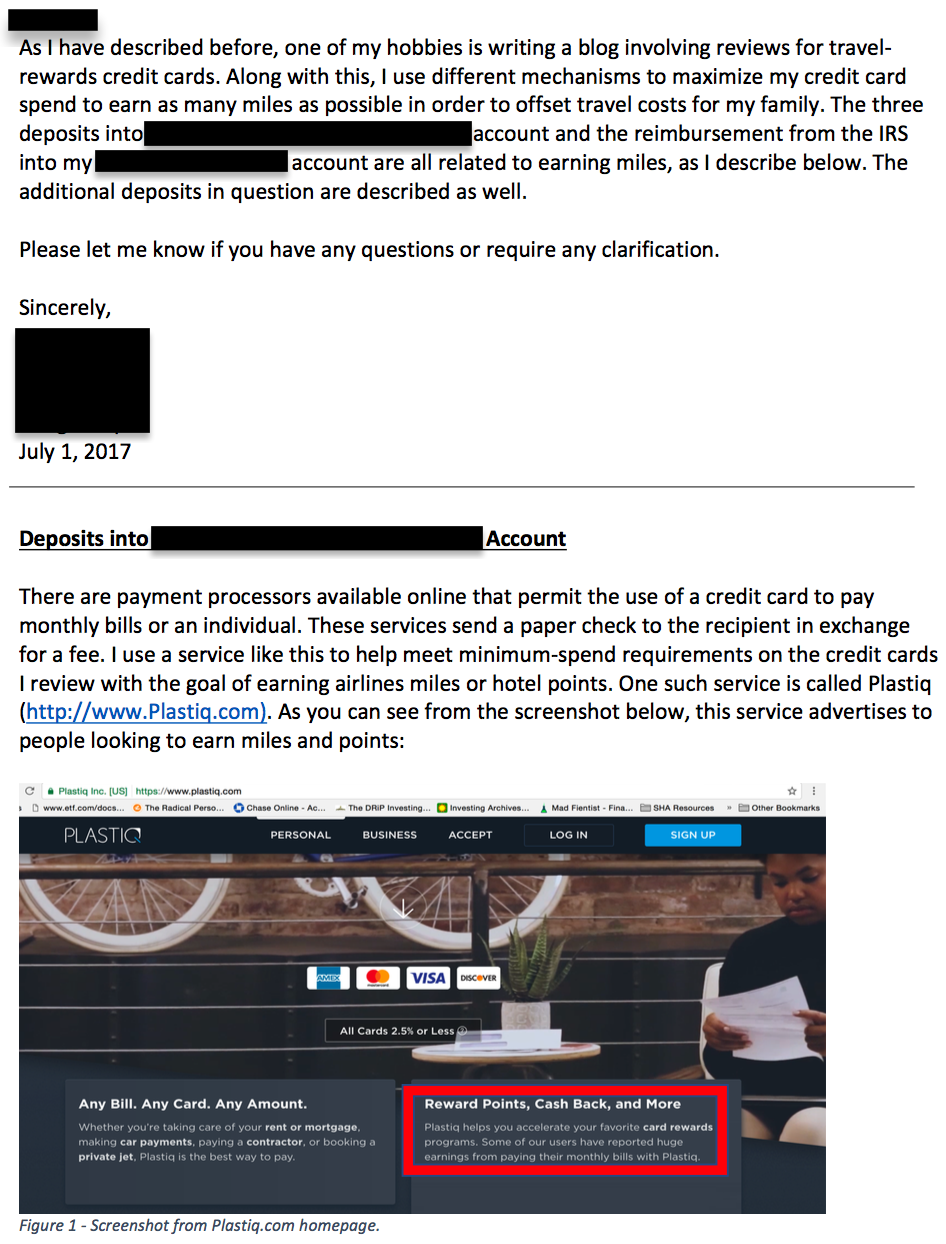

Over the past year-and-a-half, I have used Plastiq pretty heavily to meet minimum spend requirements on new accounts while earning bonus miles or points. My fiancé would pay all our bills, rent, etc. and I would send her a check through Plastiq to cover those amounts (…or something like that). She isn’t as heavily involved with this hobby as I am, and while I have separate bank accounts for any manufactured-spend based deposits, she does not. If you deposit money orders or have lots of ACH transfers, I highly recommend isolating those to an account that will not be used in your mortgage process.

In addition to the Plastiq payments, I also made an overpayment to the IRS back in February in order to meet the minimum spend on a new card. That money was returned to me via electronic deposit into the primary checking account that was being used for the down payment on my house, so I had to explain that as well.

The (redacted) letter I wrote to the Loan Officer to explain these deposits is presented below.

The next day, I received the following response from the Loan Officer regarding my explanation.

Hi XXXX,

That makes complete sense. Thank you for providing everything.

I』ll be mulling over the best way to put that in the loan file, and to see if we want anything additional.

I』ll let you know when the initial underwrite has been completed.

Thank you.

Approximately four days later, I received a phone call from the Loan Officer that our mortgage had been approved by the underwriter! Two days later we closed on the house. We are now the proud new owners of a backyard jungle and approximately a dozen palm trees!

Backyard jungle

Car Loan

The unfortunate part of moving from the west-coast to Florida is that public transportation is non-existent here. That means we had to get a second car. There isn’t much to explain here. Our lender, the credit union we use for daily banking, did not care in the least about the inquiries or new accounts on our credit reports and offered us the lowest rate we could find on the market for a used car after shopping around for rates (2.49%). There were no questions at all – I submitted the loan application and we were approved within 15 minutes.

Summary

All of our paperwork was accepted and we received a 30-year fixed-rate mortgage at 4.125%. Even with all this back and forth and the amount of explanation required, the whole process from making an offer to closing was completed in an almost unbelievable 3.5 weeks. I am writing this post from my new backyard as we speak.

We closed on the house before purchasing the new (used) car. Remember, you don’t want any type of new debt to appear on your credit report during the mortgage process. Along these lines, I also recommend you pay off any credit card debt and make sure that low credit-utilization is reflected on your credit report before proceeding with any type of loan.

I want to reiterate that this post is written based on MY story, circumstances, and the company that conducted the underwriting on my mortgage. YMMV.

Questions? Comments? Post them below and I will get back to you as soon as possible!