[2021.08 – We have updated the text and table after finding an errant calculation in our source spreadsheet. Thanks to our readers for bringing this to our attention. However, now the “inflation” is worse than we originally posted!]

Introduction

The economic concept of inflation is defined as the decline of purchasing power of a given currency over time. This effectively means that a unit of currency buys less today than it did yesterday (or last month, last year, etc.). We all know that devaluations are common within the miles and points game, which is why we generally advocate the “churn and burn” philosophy. Historically, these devaluations come when hotels or airlines change their award chart and require more miles and points for the same product than they did in the past.

When the COVID pandemic began, banks started tightening their requirements for extension of personal credit. At the same time, people stopped travelling. Miles and points represent a net liability on the books of banks/airlines/hotels, so Chase (for example) pivoted and began offering features like “Pay Yourself Back” in which you could now use points to offset grocery and home improvement purchases at the same rate that previously only applied to travel. This was a way to get people to spend more on their credit cards (income for the bank) while at the same time attempting to decrease the net liability of outstanding points on their books.

Banks and credit issuers began expanding their rate of consumer credit extension around August of 2020. Coincident with this and through the first half of 2021, we began to see all-time high signup bonus offers on a number of credit cards. I was reviewing the historical signup bonus offer charts we include on our Best Credit Card Signup Bonus Offers and wanted to provide some context for the rate of increase of these signup bonuses to draw inferences on what’s happening within the broader miles and points market.

If you’re a TL;DR type, my prediction is simple: within the next year we are likely to see widescale devaluation in many miles and points currencies to make up for losses incurred throughout the pandemic.

Also, a point of clarification. I’m using ‘inflation” as a catch-all here. In economic terms what I am really describing is an increase in the velocity of M2 “money stock,” from which inflation is a result. In this case, it’s an increase in the velocity of miles/points being printed. A nuance but one I thought I should mention.

Data Analysis

To assess the degree of all-time high signup bonus offerings on the market since the pandemic began, I looked at the top 30 products on our Best Credit Card Signup Bonus Offers page and used August 2020 to present as the timeframe for analysis. Of the top 30 products on our list, 24 hit all-time high offers (80 percent). The percent change between the historical and current all-time high signup bonus offers were then calculated. Results are provided in the table below.

Two points of clarification. First, I looked only at the miles/points of a signup bonus and did not assess statement credit bonuses within the overall signup bonus (i.e. for the Amex Delta SkyMiles Gold I used 70k miles only and didn’t account for the $200 statement credit). Second, I used a historical offer of 50k points for the Chase Sapphire Reserve as I believe the initial 100k bonus offer was a loss-leader to generate market share and is unlikely to be seen again.

This analysis includes only personal credit cards and excluded business product offers.

| Card Issuer | Product | Previous Historical High Signup Bonus | Current/Recent Signup Bonus | % Change of Current/Recent Offer Relative to Historical High Offer | |

|---|---|---|---|---|---|

| 1 | Amex | Platinum | 100,000 | 125,000 | 25% |

| 2 | Amex | Platinum for Morgan Stanley | 60,000 | 100,000 | 67% |

| 3 | Amex | Platinum for Schwab | 60,000 | 100,000 | 67% |

| 4 | Chase | Sapphire Preferred | 80,000 | 100,000 | 25% |

| 5 | Bank of America | Amtrak Guest Rewards | 40,000 | 50,000 | 25% |

| 6 | Citi | Premier | 60,000 | 80,000 | 33% |

| 7 | Bank of America | Alaska | 40,000 | 67,000 | 68% |

| 8 | Amex | Delta Skymiles Platinum | 80,000 | 90,000 | 13% |

| 9 | Amex | Delta Skymiles Gold | 60,000 | 70,000 | 17% |

| 10 | Chase | Aer Lingus | 50,000 | 100,000 | 100% |

| 11 | Chase | British Airways | 50,000 | 100,000 | 100% |

| 12 | Chase | Iberia | 50,000 | 100,000 | 100% |

| 13 | Amex | Gold | 50,000 | 75,000 | 50% |

| 14 | Chsae | United Explorer | 60,000 | 70,000 | 17% |

| 15 | Barclays | Wyndham Earner Plus | 45,000 | 90,000 | 100% |

| 16 | Barclays | Wyndham Earner Business | 45,000 | 90,000 | 100% |

| 17 | Chase | IHG Premier | 130,000 | 150,000 | 15% |

| 18 | Chase | Sapphire Reserve | 50,000 | 60,000 | 20% |

| 19 | Amex | Delta Skymiles Reserve | 80,000 | 125,000 | 56% |

| 20 | Barclays | Jet Blue | 60,000 | 100,000 | 67% |

| 21 | Amex | Hilton | 100,000 | 150,000 | 50% |

| 22 | Barclays | Wyndham Earner | 30,000 | 60,000 | 100% |

| 23 | Bank of America | Amtrak Guest Rewards Platinum | 12,500 | 20,000 | 60% |

| 24 | Amex | Marriott Bonvoy Briliant | 100,000 | 125,000 | 25% |

Data Assessment

Of the 24 products seeing all-time high offers within the past year, six are hotel cards, nine are airlines cards, and seven are bank point cards. The remaining two products are the Bank of America Amtrak cards.

The six hotel cards on our list have seen an average increase of 65% in the past year relative to their historical high signup bonus offers. Of these, the Wyndham products have seen the highest relative percent increase of 100%, followed by Hilton at 50%, Marriott at 25%, and IHG at 15%.

The nine airline cards on our list have seen an average increase of 60% in the past year relative to their historical high signup bonus offers. Of these, the Chase Aer Lingus, British Airways, and Iberia products have seen a 100% relative increase, followed by the Bank of America Alaska and Barclays Jet Blue cards at 67%, Amex Delta Skymiles Reserve at 56%, Amex Delta Skymiles Gold and Chase United Explorer at 17%, and the Amex Delta Skymiles Platinum at 13%.

The seven bank cards on our list have seen an average increase of 41% in the past year relative to their historical high signup bonus offers. Of these, the Amex Platinum for Morgan Stanley and Platinum for Schwab products have seen a 67% relative increase, followed by the Amex Platinum and Citi Premier at 33%, Chase Sapphire Preferred at 25%, and Chase Sapphire Reserve at 20%.

The Bank of America Amtrak Guest Rewards and Guest Rewards Platinum cards have seen relative increases of 25% and 60%, respectively.

Discussion

Economic inflation is a balancing act between money supply and economic output. The same is true for miles and points. It is possible (likely?) that card issuers were able to acquire miles and points they dole out as signup bonuses at a discount from the hotels and airlines during the pandemic in order to generate revenue for the beaten down travel industry. Airline and hotel points rarely become more valuable with time. Once those points hit the market in the form of signup bonuses, inflation in the points currency may occur as 1) the market gets flooded with points and 2) the hotels and airlines try to scrape cash revenue from any source they can by limiting the ability to use the points/miles ((i.e. increasing paid stays/flights by imposing blackout dates, award chart expansion/devaluation, etc.).

The same can be said for bank points. We see a big increase in the signup bonus offerings from Amex, Citi, and Chase for their in-house point programs. However, Amex is already devaluing the cash value of their points by 12% by reducing the Charles Schwab cashout rate from 1.25 cents per points to 1.1 cents per points (effective September 1, 2021).

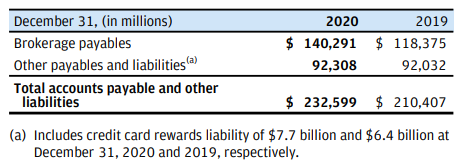

I reviewed the Chase 2020 Annual Shareholder Report to get an idea of how the pandemic impacted their credit card portfolio. Chase holds 22% of the market share for overall credit card spend as of 2020 and has the greatest sales volume and outstanding balances of any issuer. However, 2020 represented a decrease of 3% in overall credit card spend on Chase products and a net-decline of approximately 10% in delinquent balances (i.e. people paying interest) between 2019 and 2020. The Ultimate Rewards program represented a $7.7 billion liability on Chase’s books in 2020, up from $6.4 billion at the end of 2019. At the same time, the number of new credit card accounts decreased from 7.8 million in 2019 to 5.4 million in 2020. While Chase expanded the use of Ultimate Reward points by allowing statement credits at 1.5 cents per point for spend at groceries, restaurants, and home improvement stores, these changes show the strain the pandemic had on the largely travel-based Ultimate Rewards program.

Banks are in the business of making money. In my opinion, I see Chase (and other banks) making up for these losses in their credit card portfolio by 1) increasing annual fees, 2) increasing interest rates on their products, and/ or 3) devaluing the purchase power or transferability of Ultimate Rewards/Membership Rewards/Thank You points. However, I am not an economist and would love the take of anyone who may be more knowledgeable.

Conclusion

I have always been an advocate for the “churn and burn” mentality when it comes to points and miles. The least valuable points are the ones you don’t use and points don’t generally become more valuable with time. Based on the current economic climate and the need for the banks, airlines, and hotels to make up for losses and increased liabilities incurred throughout the pandemic, devaluations and/or significant fee increases are really the only outcomes I see moving forward for the majority of miles and points programs.

What do you think the future holds for the value of miles and points? Leave a comment below!