Citi Dividend Platinum Select Credit Card Review

Application Link

- This card no longer accepts new applications. If you are lucky to have this legacy credit card, you can still enjoy its original benefits.

Benefits

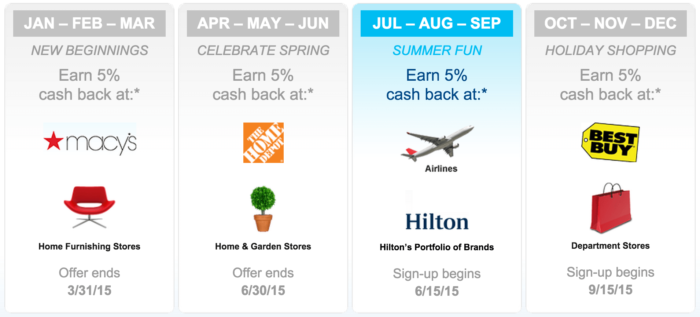

- Earn 5% cash back in each quarter’s bonus categories, 1% on all other purchases. The following picture shows the bonus category calendar for 2015:

- The upper limit of cashback you can earn per year (12 billing periods in a row beginning with the one that includes January 1st) is $300. It’s better than Chase Freedom and Discover It because there’s no $1500 spending limit per quarter, you can directly spend $6000 in a good category and get $300 cashback.

- No annual fee.

Disadvantages

- There’s an upper limit of how much cashback you can earn: the cap is $300 cashback per year.

- Compared to the same kind of 5% cash back credit cards Chase Freedom and Discover It, the bonus categories in this credit card is not so broad.

- It has foreign transaction fee, so it's not a good choice outside the US.

- No sign-up bonus.

Summary

This credit card has no annual fee and has 5% cash back bonus category in each quarter, so it is a good card to keep. The best way to get this credit card is to apply for a Citi MasterCard with high sign-up bonus (such as: Citi AAdvantage 50k Offer, Citi ThankYou Premier 50k Offer, Citi Prestige 50k/60k Offer), and then when you don’t want keep them anymore, you can convert them to this Citi Dividend credit card. Note that you may need to wait for 12~15 months to convert cards, and you can ask the customer service representatives for details about this.

Historical Offers Chart

This card stopped accepting new applications in 2014.8, and people were able to get it via product change until the 2019.9 when it was completely discontinued.

Application Link

- This card no longer accepts new applications. If you are lucky to have this legacy credit card, you can still enjoy its original benefits.