If you live in the U.S, using credit cards is both a fun and efficient way to earn rewards while spending money that you would have spent anyway! By spending a little bit of effort learning how to efficiently apply for and use credit cards, it’s very simple to earn a round trip flight to China or other countries. If you adopt credit cards and travel rewards as a hobby and dig into it, you can experience many of the finer things in life, such as first class airline tickets, five star hotels, and airport lounges. However, there are certain rules to follow. Applying for and using credit cards without a plan could prevent you from maximizing value out of credit cards and worse, it could harm your credit score.

This article aims to give people new to using credit-cards a tutorial that provides a big picture from the beginning and to avoid doing anything you might regret later. If you want to know more, please click the links for more specific topics.

1. How To Apply for Credit Cards Wisely

1.1. Do I need a Social Security Number (SSN) to apply for a credit card?

There are many cards you can get without an SSN. Read our article Credit Cards You Can Get Without SSN if you don’t have an SSN. The following sections in this article assume that you have an SSN.

1.2. The first card

This first step can be a bit troublesome. Credit card approval is mainly based on your credit hisitory. Having an SSN is different from having credit history. You can only start building your credit history once you begin a debtor-creditor relationship, such as credit cards, car loans, home loans, etc. With a blank credit history, you have almost no chance to get approval for any major credit card. Only a few credit cards are considered suitable to apply for as your first. Don’t be too concerned about the signup bonus for your first credit card. It means a lot to get approved since that will allow you to start building your credit history. Our article Credit Cards For Beginners with No Credit History introduces a few cards for beginners:

- BoA Customized Cash Rewards (SSN not required)

- Chase Freedom Rise

- Discover it

After getting your first card, it’s suggested to use it for 6 to 12 months to build your credit history. Then you can start applying for other cards once that credit history foundation is built.

It’s always hard in the beginning…

1.3. Chase 5/24

After building your credit history with your first credit card, you can in theory apply for any credit cards you want. However, almost all Chase credit cards are affected by a special rule: the Chase 5/24 Rule. This rule states that your application will be rejected automatically if you have opened 5 or more new accounts within the past 2 years, no matter how good your credit history is or how high your credit score is. Both Chase credit cards and credit cards issued by other banks are counted. Therefore, if you want to get any Chase credit card, which we suggest since many of Chase card offer great rewards, it’s better to start getting Chase cards while your number of accounts is under 5. Otherwise, you would need to wait a very long time to have the opportunity again. We strongly recommend that your 2nd to 5th credit cards be from Chase. Here’s the suggested list:

(1) UR cards

- Chase Freedom

- Chase Freedom Unlimited (CFU)

- Chase Sapphire Preferred (CSP)

- Chase Sapphire Reserve (CSR)

(2) Airline credit cards

(3) Hotel credit cards

Don’t rush too much during this period. Spend a few months to apply gradually, otherwise it can be easy to get rejected.

1.4. Other credit cards

After you manage a credit card listed above and get a longer credit history, you have much more flexibility to apply for other credit cards. You can get one credit card when it has the highest signup bonus, or get one when you are planning to spend a lot so you could meet the spending requirement easily. Our recommended card lists are the Best Rewards Credit Cards For Everyday Use and Current Best Credit Card Sign-Up Bonus. These lists mainly include:

(1) Cashback / Points cards

- AmEx EveryDay (ED) or AmEx EveryDay Preferred (EDP) or AmEx Blue Cash Everyday (BCE) or AmEx Blue Cash Preferred (BCP)

- AmEx Platinum, AmEx Gold, and other AmEx Charge Cards

- Citi Prestige or Citi ThankYou Premier

- BoA Premium Rewards

- Barclaycard Arrival Plus

- Barclaycard Uber

- Capital One Venture

- Capital One Savor

- US Bank Altitude Reserve

SFO Centurion Lounge. You will get complimentary access if you have the AmEx Platinum card.

(2) Airline credit cards

- Citi AAdvantage Platinum

- Barclaycard AAdvantage Aviator Red

- AmEx Gold Delta SkyMiles

- AmEx Platinum Delta SkyMiles

- AmEx Delta Reserve

- BoA Alaska

Emirates First Class. You can have an experience with it by accumulating airline miles.

(3) Hotel credit cards

New York St Regis. You can stay here with Marriott points.

1.5. Credit cards not recommended

Some credit cards look good at first glance, but can be extremely terrible cards. All different kinds of Store Credit Cards are in this category (e.g. employees at Macy’s, Walmart, etc will ask you to apply for their credit cards for a store discount). Credit cards with Capital One and US Bank are also considered to be in this category. We strongly recommend applying for the cards listed above if your credit history is less than 2 years. If you already have most of these cards, then you can tailor your applications more based on your own demands and considerations.

2. Credit Score

Credit Report and Credit Score (mostly by FICO) are key factors in approval of credit cards. For credit cards owners, it is very important to know about their Credit Reports and FICO Credit Scores. Please refer to How To Get Free Credit Reports And Scores for how to check your credit score, and refer to How To Improve Credit Score to learn about what inputs go into your credit score and ways to improve it.

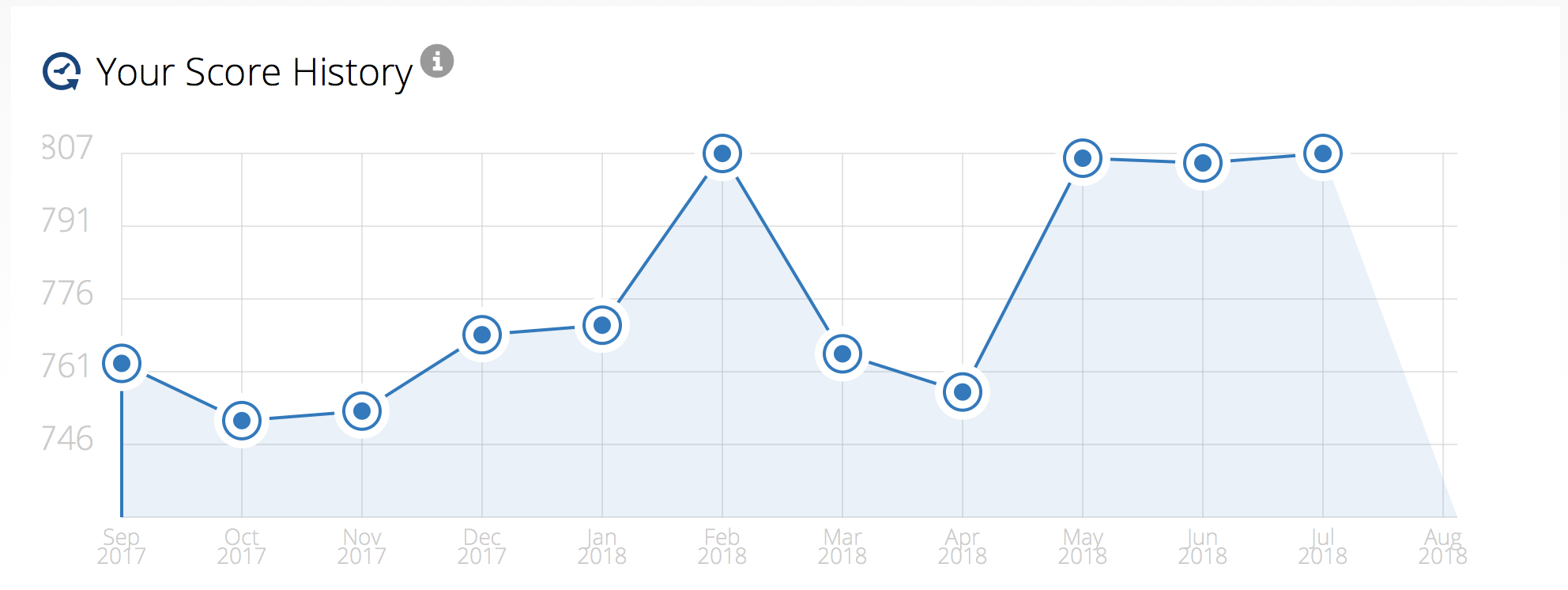

A common question for people who don’t know credit cards very well is: Will applying for a lot of credit cards make my credit score terrible? The answer is that it depends. For every new credit card you get, it negatively impacts your credit score in the short term: if you get a Hard Pull (HP) and a new account with no credit history, you will see a drop of your credit score. However, the impact of a HP disappears after two years, new accounts gradually become old accounts, and in the long term your utilization goes down. All of these things will positively affect your credit score. If you control the rate that you get new cards very well, it’s possible to not only keep a good credit score all the time but also to have one that is much higher than people who only hold one credit card after 10 years. Of course, if you have plans to apply for a home loan in the near future, you will really need to consider the short term impact of new accounts on your credit score. In this case, it’s better to avoid getting new credit cards for at least 6 months.

Another common question is: after getting so many credit cards with annual fees, if we want to close the cards to avoid paying annual fees, will it make our credit score terrible? After the first year, you may not need to actually close a credit card with an annual fee since it might be possible to downgrade to another card without an annual fee to keep the account open. Also, the credit score model doesn’t directly consider closed accounts. Closing an account does not have a large direct impact, especially if you have a lot of cards without annual fees. Your credit score could still be good when you open/close cards with discipline.

Even with dozens of credit cards, it may not be a bad thing for your credit score in the long term.

3. How to Use Points

After applying for many credit cards, you will receive a plethora of bank points, airline miles, and hotel points. Within two years, you easily generate hundreds of thousands or even a million combined points/miles.

Though we have estimated values for different kinds of points, estimated values are just that, estimates. In practice, it’s not a fixed rate. If you know how to maximize the value of your points, the real value could be more than the estimated values. There are a lot of tricks about how to make the best use of these miles and points.

3.1. Transferable Points

The primary transferable points include Chase UR, AmEx MR, Citi TYP and SPG. Maximize Your Credit Card Points Values is a brief introduction on how to use these bank points. Basically, the best use of these points is to transfer them to specific airlines or hotel chains. Read our individual guides for more details:

- Chase Ultimate Rewards (UR) How to Use

- AmEx Membership Rewards (MR) How to Use

- Citi ThankYou Points (TYP) How to Use

- SPG How to Use

3.2. Airline Miles

It’s not always required to redeem a specific airline award ticket within its own program. For instance you are allowed to redeem United miles on All Nippon flights because they are a partner airline. Each airline has its own rules to use miles. Although it increases the complexity of using miles, it also brings more opportunities to get enhanced value out of them. There’s no doubt that maximizing value requires effort. See Basics of Airline Miles Redeeming for some basic knowledge. For more detailed information about each airline, please take a look at our Airline Miles Guides. Here’s a few of the most common airlines along with some transfer ratios:

(1) Star Alliance:

- United Airlines (UA) Miles Guide (UR 1:1. SPG 1:0.5)

- All Nippon Airways (ANA, NH) Miles Guide (MR 1:1. SPG 1:1.25)

- Air Canada (AC) Miles Guide (MR 1:1. SPG 1:1.25)

- Avianca (AV) Miles Guide (TYP 1:1. SPG 1:1.25)

- Singapore Airlines (SQ) Miles Guide (UR 1:1. MR 1:1. TYP 1:1. SPG 1:1.25)

(2) OneWorld:

- American Airlines (AA) Miles Guide (SPG 1:1.25)

- Cathay Pacific Asia Miles Guide (MR 1:1. TYP 1:1. SPG 1:1.25)

- British Airways (BA) Miles Guide (UR 1:1. MR 1:1. SPG 1:1.25)

- Japan Airlines (JL) Miles Guide (SPG 1:1.25)

(3) SkyTeam:

- Delta Airlines (DL) Miles Guide (MR 1:1. SPG 1:1.25)

- Flying Blue Miles Guide (UR 1:1. MR 1:1. TYP 1:1. SPG 1:1.25)

- Korean Air (KE) Miles Guide (UR 1:1. SPG 1:1.25)

(4) Other airlines:

- Southwest Airlines (SW, WN) Miles Guide (UR 1:1)

- Alaska Airlines (AS) Miles Guide (SPG 1:1.25)

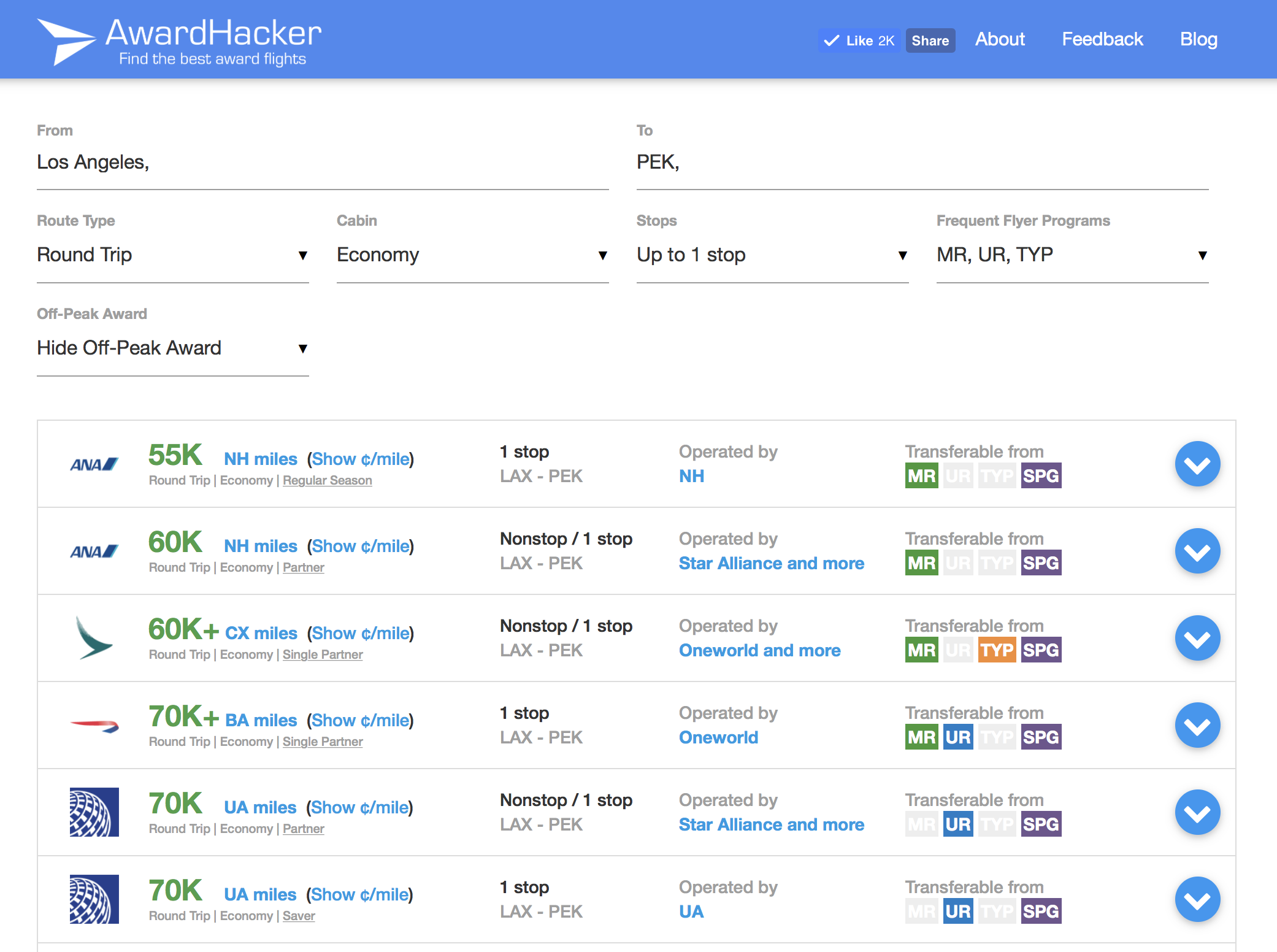

We made a specific tool called AwardHacker, which shows clearly which airline costs the least miles from place A to place B.

AwardHacker. The screenshot above shows the number of miles needed to redeem for a round trip from LAX to PEK.

3.3. Hotel Points

The best use for hotel points is simply to redeem them for reward nights. It’s relatively simple but there are still tricks. Please refer to our Hotel Points Guides.

Our strategic partner made a fantastic tool called Yeek, which shows you which hotel is the best to redeem your hotel points or free night certificates.

4. Bottom Line

We have published a lot of posts, and they contain a lot of useful information. Use the search function in our blog wisely, and you can probably find answers to most of your questions.

Applying for and using credit cards is a money-saving and fun hobby. We wish everyone happiness in their journey with credit cards! If you have any questions, feel free to leave any comments below!

Don’t want to miss great credit card deals? Please download our app and enable the notifications!